Developer receiving $20 million in City and State tax breaks hires out of state contractors at below area rates

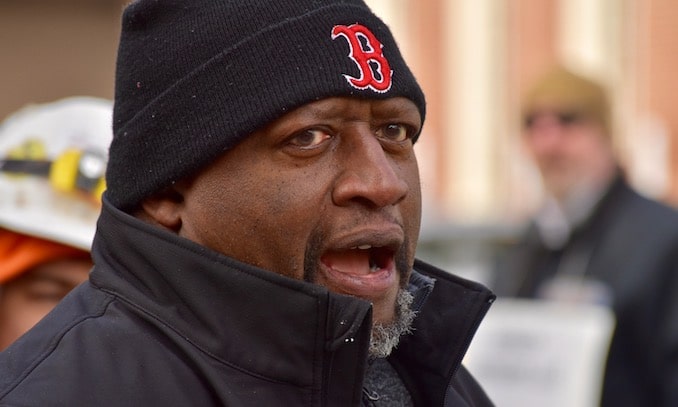

“We’re out here for an area standards and wages rally,” said Carpenters Union Local 330 Lead Organizer Ernesto Belo. “Callahan brings in subcontractors from out of state, no apprenticeship programs, no benefits to the community. Between the city and state this project received almost $20 million in tax relief, to no benefit to the community and the people in it.”

February 11, 2019, 3:11 pm

By Steve Ahlquist

“We’re out here for an area standards and wages rally,” said Carpenters Union Local 330 Lead Organizer Ernesto Belo. “Callahan brings in subcontractors from out of state, no apprenticeship programs, no benefits to the community. Between the city and state this project received almost $20 million in tax relief, to no benefit to the community and the people in it.”

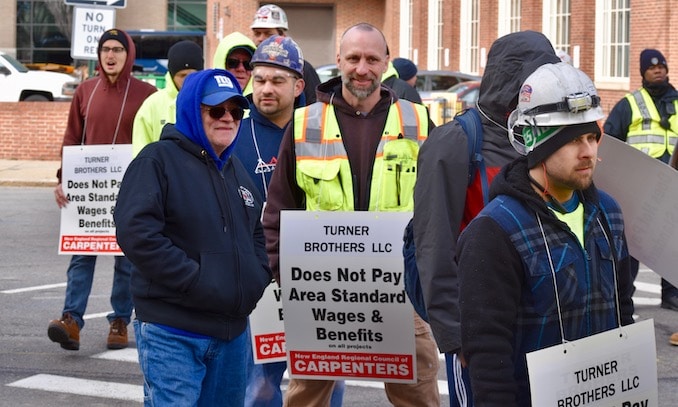

On Monday, members and representatives of Carpenters Union rallied outside of the construction project at 78 Fountain Street. The project was pitched to the City of Providence by local developer Buff Chace and then sold to an out-of-state developer shortly after the city’s tax stabilization agreement and Rebuild Rhode Island tax credits were approved. The credits and tax deferment plan add up to nearly $20 million.

When the carpenter’s union found out that Callahan Incorporated was chosen to be the general contractor for the project, alarm bells went off. According to the Carpenters Union, Callahan has a well-documented history of hiring subcontractors that engage in wage theft schemes, tax fraud and exploiting immigrant workers.

Since last week, the Carpenters Union has been maintaining a picket line at the construction site to protest Turner Brothers, the concrete subcontractor Callahan is using on the project. The Carpenters Union alleges that carpenters who work for Turner Brothers are paid far below the area standard wages for a carpenter, contributing to an erosion of the industry.

“City tax relief should produce local jobs that pay a fair wage,” said Belo. “We look forward to working with the city where we live and work to reform the TSA program to include worker protections, workforce diversity goals and a local hiring policy.”

UpriseRI is entirely supported by donations and advertising. Every little bit helps:

Become a Patron!