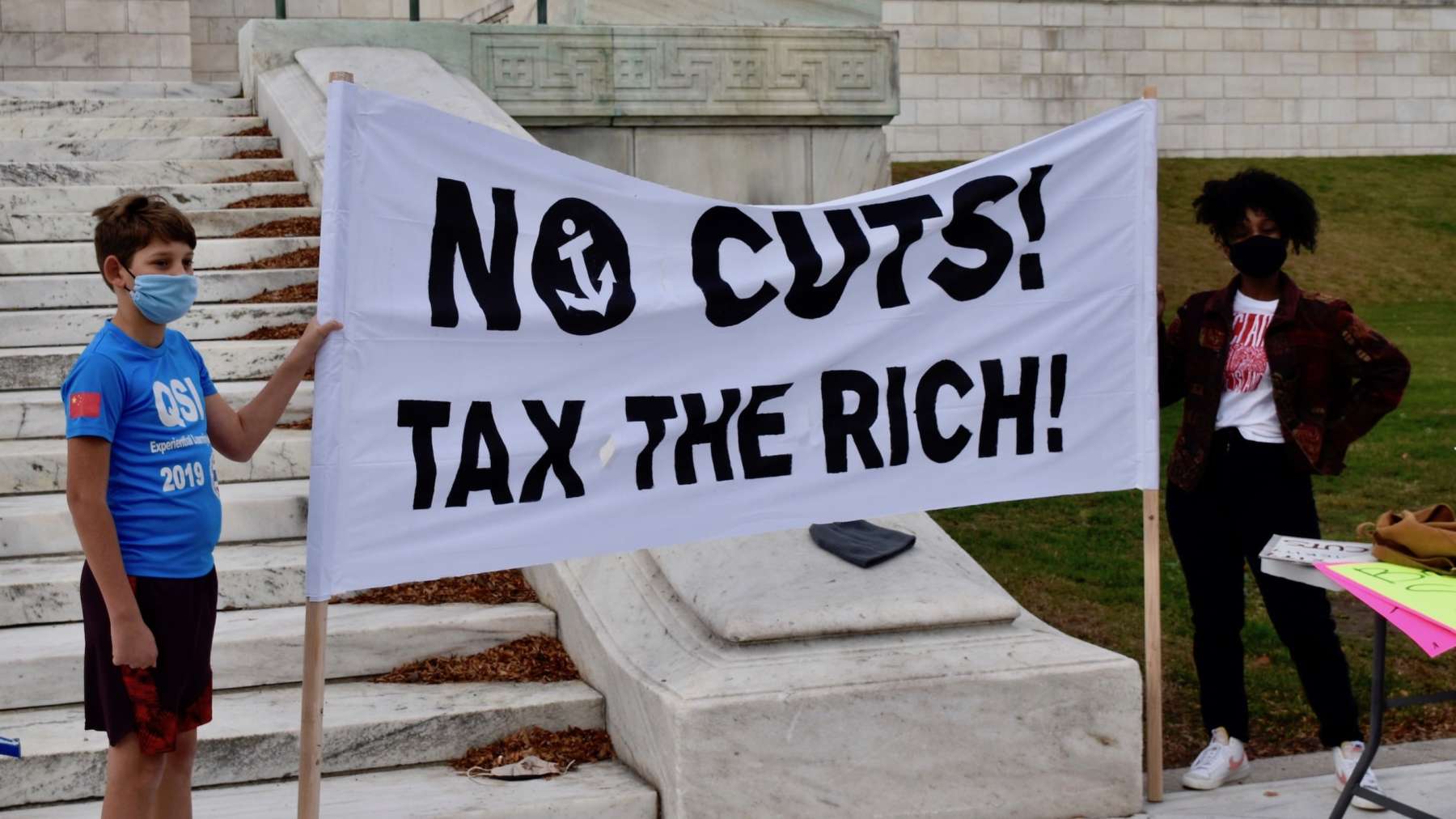

Coalition rallies for taxes on rich to fund essential services

“While it is not well known, in 2006 the State of Rhode Island cut taxes for the wealthiest Rhode Island residents, allowing them to go from paying a ten percent income tax rate to a six percent income tax rate,” said State Representative-elect David Morales. “The same rate that most of you are paying. That has created a regressive tax code that is putting the burden on working people.”

November 21, 2020, 8:47 pm

By Steve Ahlquist and

Lawmakers and advocates gathered with over 100 attendees at the State House on Saturday with a clear demand: Raise taxes on the very wealthiest Rhode Islanders and invest in key social services. The State House rally was cosponsored by Reclaim RI, DARE (Direct Action for Rights and Equality), RI Working Families Party, The Womxn Project, the Economic Progress Institute, Providence Democratic Socialists of America, Formerly Incarcerated Union of Rhode Island, Carpenters Union Local 330, Demand Progress, George Wiley Center, IUPAT DC 11, and others.

Organizers and elected officials highlighted years of decreases in taxes for the wealthiest Rhode Islanders, while taxes and fees have stayed steady or increased for the majority of our state. Every year, instead of taxing the wealthy to make up gaps, state leaders balance the budget by cutting programming that supports low- and middle-income Rhode Islanders. All speakers stressed the importance of raising taxes on those with an income of over $475,000 per year. In this particularly difficult time of COVID, speakers implored state leaders to ensure that essential services like schools, infrastructure, and services for people with disabilities, the formerly incarcerated, and low-income people are well-funded precisely when they are needed most.

Rally organizers said they are committed to ensuring that the state budgets for both 2021 and 2022 prioritize investments in healthcare for vulnerable Rhode Islanders, low-income families, and seniors; supports for frontline workers; quality, culturally relevant education; safe school buildings free of police harassment and violence; expanded childcare funding; efforts to decrease police interactions and incarceration for the state’s low-income communities of color; and effective re-entry housing, training, and services for those leaving incarceration.

As event facilitator David Veliz, Director of the Rhode Island Interfaith Coalition To Reduce Poverty said, “Rhode Island is facing a historic set of economic, social, and environmental crises. This is no time to cut spending on vital social services. The only way we can save the lives of our neighbors is to invest in each other. The community, and elected officials, have made it clear that they won’t support a budget that asks our most struggling neighbors to bear more of the burden. It’s time for those who can afford to pay more to do so.”

“This Legislation is not only about money, it’s more importantly about people,” said Representative Karen Alzate (Democrat, District 60, Pawtucket). “Communities like Pawtucket, and districts like mine, predominantly immigrant, low-income, cannot continue to be held responsible to pay the bigger share of taxes. If this pandemic has shown us anything, it’s that we need to care for humanity, and that includes raising taxes on the one percent, so we can help our most vulnerable populations.”

Reclaim RI co-chair Rithika Ramamurthy led the over 100 attendees in chants between speakers.

“In the early 1990s, the top income tax rate on the richest Rhode Islanders was 12 percent – now, it’s six percent,” said Mie Inouye, Reclaim RI Membership Coordinator. “Meanwhile, taxes on the median taxpayer have barely decreased at all. And the services that ordinary Rhode Islanders depend on are cut, year after year. It’s time to reverse course. We call on our elected officials to pass a state budget that takes care of the people, not the one percent.”

“As a young person, and organizer in Rhode Island, I interact with underfunded institutions and resources every single day,” said Jayson Rodriguez, Senior at The Met High School and organizer with Providence Student Union (PSU) and DARE. “I’ve attended schools with old water fountains, no nurses or mental health counselors, and overfunded, and unnecessary armed police officers. These funding inequities exist because of the lack of prioritization of human health and safety. These inequities extend to places like our prisons, and the humans that need sustainable reentry into our society. Funding for equitable housing, mental health services, and education should not be a debate with the wealthy and those in power. These issues affect everyone, and nobody should be deprived of basic human rights.”

Reclaim RI co-chair Rithika Ramamurthy.

“What is it that gets compromised when politicians sit down at the table?” asked Kinverly Dicupe, and organizer at Reclaim RI and co-chair of the Providence Chapter of Democratic Socialist of America. “Who’s needs is it that are constantly on the chopping block? Somehow, in these compromises, it’s always the poorest and most vulnerable people who have their needs not met. It’s always people like me.

“I must ask, as someone who lives in public housing, as someone who lived with lead, as someone who has endured long winters without heat or water, who stands before you unemployed, “Why do you ask me to sacrifice?'”

“An austerity budget is not the answer,” said State Representative-elect David Morales (Democrat, District 7, Providence). “Instead, we can finally begin working towards a fair tax code where the wealthy Rhode Islanders pay their fair share.

“While it is not well known, in 2006 the State of Rhode Island cut taxes for the wealthiest Rhode Island residents, allowing them to go from paying a ten percent income tax rate to a six percent income tax rate. The same rate that most of you are paying. That has created a regressive tax code that is putting the burden on working people.”

Reclaim RI co-chair Rithika Ramamurthy closed the rally out with more chants.

[This piece is partly from a Reclaim RI press release.]