Rhode Island State House Thursday, May 6, 2021

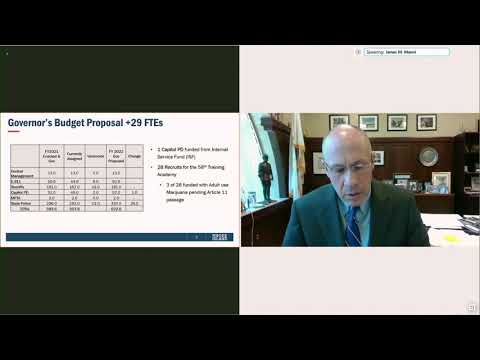

Thursday, May 6, 2021 1pm Governor’s Press Conference on COVID-19 3pm Senate Committee on Finance SCHEDULED FOR HEARING: H6122 (Governor) by Abney ENTITLED, AN ACT MAKING APPROPRIATIONS FOR THE SUPPORT OF THE STATE FOR THE FISCAL YEAR ENDING JUNE 30, 2022 Department of the Attorney General: FY2021 Supplemental and FY2022 Budgets Department of Public Safety: FY2021 Supplemental and FY2022 Budgets

May 6, 2021, 8:05 pm

By Uprise RI Staff

Thursday, May 6, 2021

1pm Governor’s Press Conference on COVID-19

3pm Senate Committee on Finance

SCHEDULED FOR HEARING:

- H6122 (Governor) by Abney ENTITLED, AN ACT MAKING APPROPRIATIONS FOR THE SUPPORT OF THE STATE FOR THE FISCAL YEAR ENDING JUNE 30, 2022

- Department of the Attorney General: FY2021 Supplemental and FY2022 Budgets

- Department of Public Safety: FY2021 Supplemental and FY2022 Budgets

3pm Senate Committee on Housing & Municipal Government

SCHEDULED FOR CONSIDERATION

- S0655 by Coyne, Seveney, Felag ENTITLED, AN ACT RELATING TO WATERS AND NAVIGATION – BRISTOL COUNTY WATER SUPPLY (This act would delete a portion of the enabling statute for the Bristol County Water Authority.)

- S0656 by Coyne, Seveney ENTITLED, AN ACT RELATING TO WATERS AND NAVIGATION – BRISTOL COUNTY WATER SUPPLY (Repeals the requirement that the Bristol County water authority maintain its reservoirs, wells and well sites, transmission lines and water treatment plants within its jurisdiction in good, sound and safe condition.)

SCHEDULED FOR HEARING AND/OR CONSIDERATION

- S0391 by Quezada ENTITLED, AN ACT RELATING TO PUBLIC UTILITIES AND CARRIERS – RHODE ISLAND PUBLIC TRANSIT AUTHORITY (Increases the number of members of the transit authority from eight to nine and would make the mayor of Providence or designee an ex officio member with voting privileges.)

- S0500 by Bell, Quezada, Mack, Lombardo, Goodwin, Murray, Acosta, Kallman, Cano, Ciccone ENTITLED, AN ACT RELATING TO TOWNS AND CITIES – ZONING ORDINANCES-NEIGHBORHOOD (Amends several sections of the Rhode Island Zoning Enabling Act of 1991 with the intent of preserving neighborhood character and promoting smart growth.)

- S0794 (Department of Transportation) by Goodwin ENTITLED, AN ACT RELATING TO MOTOR AND OTHER VEHICLES – SIZE, WEIGHT, AND LOAD LIMITS (Authorizes the department of transportation to impose a weight restriction or close any state, local or privately-owned bridge, in the interest of public safety.)

- S0831 by de la Cruz ENTITLED, AN ACT RELATING TO TAXATION – LEVY AND ASSESSMENT OF LOCAL TAXES (Eliminates a duplication in the general laws by repealing one section of law that provided a tax levy and stabilization plan in the town of Burrillville.)

- S0833 (Department of Transportation) by Lombardo, F Lombardi ENTITLED, AN ACT RELATING TO MOTOR AND OTHER VEHICLES – SIZE, WEIGHT, AND LOAD LIMITS (Transfers all responsibility for oversize/overweight permitting to the department of transportation and amends and increases fines for all oversize and overweight infractions.)

- S0862 by Felag ENTITLED, AN ACT VALIDATING AND RATIFYING AMENDMENTS TO THE HOME RULE CHARTER OF THE TOWN OF BRISTOL (Validates and ratifies amendments to the Home Rule Charter of the town of Bristol, which amendments were adopted and approved by the electors of the town of Bristol on November 3, 2020.)

3:15pm Press Conference Waste Act of 2021

4pm Rhode Island House

Whip Kazarian’s bill that would ban gender discrimination in health insurance premiums passes the House

House Majority Whip Katherine S. Kazarian’s (D-Dist. 63, East Providence) legislation (2021-H 5763) that would ban health insurers from utilizing the discriminatory practice known as gender rating, or routinely charging women and men different premiums for individual insurance, passed the House of Representatives tonight.

“The discrimination that women have faced when it comes to the costs of health insurance has existed for far too long and needs to end. If we truly value the positive impacts of regular healthcare, there is no reason women should be discriminated against and forced to pay much-higher rates for their medical care. This bill will eliminate this gross injustice and finally bring women in our state the healthcare equality that they rightfully deserve,” said Whip Kazarian.

This bill would prohibit insurance companies from varying the premium rates charged for a health coverage plan based on the gender of the individual policy holder, enrollee, subscriber, or member. The bill will codify into Rhode Island law a practice that has already been instituted federally within the Affordable Care Act.

When it comes to health insurance, women are considered a higher risk than men because they tend to visit the doctor more frequently, live longer, and have babies. The practice is similar to what minorities faced in this country, with race being used to justify higher healthcare costs, until the passage of the 1964 Civil Rights Act.

Research from a 2012 National Women’s Law Center report entitled, “Turning to Fairness: Insurance Discrimination Against Women Today and the Affordable Care Act,” states that 92 percent of best-selling plans charge women more for health insurance coverage than men in states without laws banning gender rating. Only 3 percent of these plans cover maternity services. It also states that the practice of gender rating costs women approximately $1 billion per year, based on an average of 2012 advertised premiums and the most recent data on the number of women in the individual health insurance market. Excluding maternity coverage, the report further says that nearly one-third of plans examined charge 25- to 40-year-old women at least 30 percent more than men for the same coverage. In some cases, the difference is even greater.

The National Women’s Law Center is a research and advocacy group, which works to expand, protect and promote opportunity and advancement for women and girls.

The bill now heads to the Senate for consideration where Sen. V. Susan Sosnowski (D-Dist. 37, South Kingstown, New Shoreham) has introduced similar legislation (2021-S 0003). (From a press release)

House passes legislation making RI Promise program permanent

The House of Representatives today approved legislation (2021-H 5224) sponsored by House Speaker K. Joseph Shekarchi to permanently enact the Rhode Island Promise program, which provides up to two years of free tuition for eligible Rhode Islanders at Community College of Rhode Island.

The program is currently set to expire with the class entering CCRI in September 2021. Speaker Shekarchi’s bill would remove the sunset provision altogether, making the program permanent.

“The Promise program is an excellent example of how we can prioritize affordable college options for all Rhode Islanders. The best investment we can make to help individuals achieve their goals is to give them the access to a college education, which is the pathway to a brighter future,” said Speaker Shekarchi (D-Dist. 23, Warwick).

The program was proposed by Gov. Gina Raimondo in 2017, and is open only to students graduating high school who begin CCRI the following fall. To keep the scholarship, they must be full-time students who qualify for in-state tuition, maintain at least a 2.5 GPA, and remain on track to graduate on time. As a “last-dollar” scholarship program, it funds only the remaining costs of tuition and mandatory student fees after Pell Grants and other sources of scholarship funding are factored in.

When originally proposed, Rhode Island Promise had a sunset provision that would have made it expire with the class that graduated high school in 2020 and entered CCRI that fall. The General Assembly included an expansion in the 2021 budget, extending to the program for students who are currently high school seniors. With the passage of Speaker Shekarchi’s legislation, the program would be available to students in perpetuity. It currently costs approximately $7 million per year.

The legislation is cosponsored by Representatives Grace Diaz, Gregg M. Amore, Jacquelyn Baginski, Majority Leader Christopher R. Blazejewski, Majority Whip Katherine Kazarian, and Representatives Brandon C. Potter, Leonela Felix, Nathan W. Biah, and Jose F. Batista.

The measure now moves to the Senate, where companion legislation (2021-S 0079) was introduced by Senate President Dominick Ruggerio and was passed by the full Senate on April 13, 2021. (From a press release)

IN ORDER:

- H5130A by Bennett ENTITLED, AN ACT RELATING TO LABOR AND LABOR RELATIONS – MINIMUM WAGES

- H5851 by Shekarchi ENTITLED, AN ACT RELATING TO LABOR AND LABOR RELATIONS – MINIMUM WAGES

- H5224A by Shekarchi ENTITLED, AN ACT RELATING TO EDUCATION

- H5763 by Kazarian ENTITLED, AN ACT RELATING TO INSURANCE – ACCIDENT AND SICKNESS INSURANCE POLICIES

- H5491 by Ackerman ENTITLED, AN ACT RELATING TO EDUCATION – FINANCIAL LITERACY

5pm (Rise) House Committee on Finance

SCHEDULED FOR CONSIDERATION

- H5013 by Slater ENTITLED, AN ACT RELATING TO TAXATION – PERSONAL INCOME TAX (Raises the earned income tax credit from 15% to 20% for tax years beginning on or after January 1, 2021.)

- H5114 by Casimiro, Craven, McEntee, Fogarty, Bennett ENTITLED, AN ACT RELATING TO TAXATION – PRECEPTORS TAX CREDIT ACT (Allows for a tax credit of $500 for certain nurse practitioners or physicians.)

- H5117 by Solomon, Noret, Casimiro ENTITLED, AN ACT RELATING TO TAXATION – EDUCATION ASSISTANCE AND DEVELOPMENT TAX CREDIT (Creates a tax credit for the amount in excess of $10k contributed to a public school district for the express purpose of making physical improvements to a school.)

- H5212 by Kazarian, Carson, Cortvriend, Fogarty, Amore, Felix ENTITLED, AN ACT RELATING TO TAXATION – PERSONAL INCOME TAX (Allows Rhode Island personal income taxpayers to deduct from their adjusted gross income all medical and dental expenses as allowed by the Internal Revenue Service.)

- H5215 by Phillips, Serpa, Hawkins, S Lima ENTITLED, AN ACT RELATING TO TAXATION – ESTATE AND TRANSFER TAXES-LIABILITY AND COMPUTATION (Increases the exemption for estate taxes to $2.5m effective January 1, 2023. There would be a further increased estate tax exemption to $5m effective January 1, 2025.)

- H5227 by Alzate, Amore, Blazejewski, Williams, Speakman, Giraldo, Slater, Kazarian, Potter, Diaz ENTITLED, AN ACT RELATING TO TAXATION – PERSONAL INCOME TAX (Adds one new income tax bracket for purposes of state income taxation.)

- H5229 by Amore, Alzate, Tanzi, Kislak ENTITLED, AN ACT RELATING TO TAXATION – PERSONAL INCOME TAX (Creates a new income tax bracket of 6.99% on taxable income over five hundred thousand dollars. Any tax collected on this income deposited into restricted receipt account and expended on education for grades kindergarten through twelfth grade.)

- H5363 by McNamara, Noret ENTITLED, AN ACT RELATING TO TAXATION – PERSONAL INCOME TAX (Act provides non qualifying individuals for social security benefits and who receive pension income may exclude pension income equal to excluded social security income or exclude maximum of $15k in pension income.)

- H5366 by O’Brien ENTITLED, AN ACT RELATING TO TAXATION – PERSONAL INCOME TAX (Raises the earned-income tax credit from 15% to 50% for the tax years 2022 and beyond.)

- H5493 by Place ENTITLED, AN ACT RELATING TO TAXATION – PERSONAL INCOME TAX (Allows volunteer firefighters who pay for their own training and equipment to receive an income tax credit if those expenses are not reimbursed by their employer.)

- H5528 by Kazarian, Baginski, Alzate, Potter, Caldwell, Felix, Morales, Henries, Shanley, Solomon ENTITLED, AN ACT RELATING TO TAXATION – PERSONAL INCOME TAX (Allows a deduction from federal adjusted gross income for interest payments on outstanding student loans.)

- H5647 by Morales, Potter, Ranglin-Vassell, Henries, J Lombardi ENTITLED, AN ACT RELATING TO TAXATION (Establishes a surtax on the business corporation tax for publicly traded corporations subject to SEC disclosure and reporting requirements, if corporation’s ratio of compensation for its CEO to median worker is equal to or greater than 100 to 1.)

- H5677 by Casey, Azzinaro, Vella-Wilkinson, Tobon, Knight ENTITLED, AN ACT RELATING TO TAXATION – PERSONAL INCOME TAX (Creates a tax deduction for military retirement benefits of a veteran or the veteran’s surviving spouse.)

- H5678 by Casey, Newberry, Phillips, S Lima, Edwards ENTITLED, AN ACT RELATING TO TAXATION – PERSONAL INCOME TAX (Exempts from state taxation certain pension benefits that originate from, and were taxed in another state.)

- H5681 by Ruggiero, Craven, Potter, Shanley, Carson, Vella-Wilkinson, Ajello ENTITLED, AN ACT RELATING TO TAXATION – PROPERTY TAX RELIEF (Provides a state-funded tax credit for home owners, renters and the disabled who are housing cost-burdened subject to age and income limitations.)

- H5690 by Casey, Azzinaro, Vella-Wilkinson, Tobon, Knight ENTITLED, AN ACT RELATING TO TAXATION – PROPERTY TAX RELIEF (Defines as “disabled” persons receiving veterans’ affairs disability benefits paid by the federal government for purposes of property tax relief.)

- H5797 by Fenton-Fung, Casimiro, Shallcross Smith ENTITLED, AN ACT RELATING TO TAXATION – BUSINESS CORPORATION TAX (Reduces small business employing less than 50 full time employees tax liability by 50% if employs 80% of full time employee staff level for last three months of 2021 based on staff level on 12/31/19 with maximum or non-operational small business in 2019.)

- H6072 by Morgan, Nardone, Roberts ENTITLED, AN ACT RELATING TO TAXATION – ESTATE AND TRANSFER TAXES – LIABILITY AND COMPUTATION (Exempts from the estate tax all property up to the value of $5m.

5pm (Rise) House Committee on Municipal Government & Housing

SCHEDULED FOR CONSIDERATION

- H5586 by Hull, Cardillo, Perez, Hawkins, Ackerman, Fogarty, McLaughlin, Costantino, Slater, Corvese ENTITLED, AN ACT RELATING TO TAXATION – PROPERTY SUBJECT TO TAXATION – EXEMPTIONS (Includes the real and tangible personal property of St. John Baptist De La Salle Institute, d/b/a La Salle Academy, a Rhode Island domestic nonprofit corporation, located in Providence, Rhode Island, on the list of properties exempt from taxation.)

- H5815 (University of Rhode Island) by Hull, McLaughlin, Barros, Perez, Costantino ENTITLED, AN ACT RELATING TO TOWNS AND CITIES – EMERGENCY POLICE POWER (Authorizes higher education institution department to enter into an agreement with any city/town to provide police assistance in non emergency situations.)

- H5016 by Slater ENTITLED, AN ACT RELATING TO TAXATION – PROPERTY SUBJECT TO TAXATION – EXEMPTIONS (Includes the real and tangible personal property of The Providence Community Health Centers, a Rhode Island domestic nonprofit corporation, located in Providence, Rhode Island, on the list of properties exempt from taxation.)

- S0102 by Goodwin ENTITLED, AN ACT RELATING TO TAXATION – PROPERTY SUBJECT TO TAXATION – EXEMPTIONS (Includes the real and tangible personal property of The Providence Community Health Centers, a Rhode Island domestic nonprofit corporation, located in Providence, Rhode Island, on the list of properties exempt from taxation.)

- S0708 by Lawson ENTITLED, AN ACT RELATING TO A TAX AGREEMENT BETWEEN THE CITY OF EAST PROVIDENCE AND EXXONMOBIL OIL CORPORATION (Provides for a tax treaty between the city of East Providence and ExxonMobil Oil Corporation subject to the ratification of the East Providence city council.)

SCHEDULED FOR HEARING AND/OR CONSIDERATION

- H6238 by Knight, Cassar, Speakman, Amore, McEntee ENTITLED, AN ACT RELATING TO TAXATION – LEVY AND ASSESSMENT OF LOCAL TAXES (Authorizes cities/towns to establish a property tax credit program in exchange for volunteer service by persons over age 60 up to $1,500 calculated by multiplying service hours by the state minimum wage per hour.)

- H6239 by Kislak ENTITLED, AN ACT RELATING TO ALCOHOLIC BEVERAGES – RETAIL LICENSES (Allows Little Sister located at 737 Hope Street in Providence to obtain a class B liquor license to sell beer and wine.)

- H6270 by Speakman, Donovan ENTITLED, AN ACT RELATING TO TOWNS AND CITIES – EMERGENCY POLICE POWER (Allows the Bristol police department to receive assistance from police departments of nonadjacent cities and towns and the department of public safety for events sponsored by the Bristol Fourth of July committee.)

- H6271 by Ruggiero ENTITLED, AN ACT RELATING TO ALCOHOLIC BEVERAGES – RETAIL LICENSES (Allows a new restaurant to be located at 53 Narragansett Avenue in Jamestown to obtain a class BVL liquor license to sell beer and wine.)

5pm Senate Committee on Commerce

SCHEDULED FOR HEARING AND/OR CONSIDERATION

- S0025 by Seveney, Acosta, Anderson, Calkin ENTITLED, AN ACT RELATING TO PUBLIC UTILITIES AND CARRIERS – NONREGULATED POWER PRODUCER CONSUMER BILL OF RIGHTS (Excludes municipal and government bodies that aggregate electrical loads for residential retail customers from the requirement that a new contract is required when there is a change of terms for electric-generation services.)

- S0203 by Picard ENTITLED, AN ACT RELATING TO INSURANCE – CLAIMS ADJUSTERS (Authorizes department of insurance, within the DBR, in lieu of passing in-state licensing examination, to recognize the competence of an applicant for an insurance claims adjuster license, through an out-of-state proctored examination.)

- S0204 by Anderson, DiMario, Calkin, Mendes, Valverde, Murray, Picard ENTITLED, AN ACT RELATING TO PUBLIC UTILITIES AND CARRIERS – PUBLIC UTILITIES COMMISSION (Requires that electrical distribution companies submit a time of use rate plan to the PUC setting forth high and on-demand times. The time of use rate plans are to be implemented on or before January 1, 2022.)

- S0339 by Sosnowski, Valverde, Coyne ENTITLED, AN ACT RELATING TO PUBLIC UTILITIES AND CARRIERS – APPLIANCE AND EQUIPMENT ENERGY AND WATER EFFICIENCY STANDARDS ACT OF 2021 (Establishes minimum energy and water efficiency standards for appliances and specified equipment purchased or installed after January 1, 2023.)

- S0452 by Raptakis, Rogers, Archambault, Paolino, de la Cruz ENTITLED, AN ACT RELATING TO HEALTH AND SAFETY – UTILITY DISTRICT ENERGY COSTS (Requires the state to pay the energy costs necessary to supply public street lighting if the local utility district fails to do so.)

- S0570 (Governor) by DiPalma, Euer, Sosnowski, McCaffrey, Goodwin, Pearson, Picard, Seveney ENTITLED, AN ACT RELATING TO PUBLIC UTILITIES AND CARRIERS – DUTIES OF UTILITIES AND CARRIERS (Requires every electric distribution company and natural gas distribution company to submit to the division of public utilities and carriers an emergency response plan for review and approval.)

- S0631 by F Lombardi ENTITLED, AN ACT RELATING TO INSURANCE – CREDIT FOR REINSURANCE ACT (Updates the credit for reinsurance chapter of the general laws to conform to the current standard set by the National Association of Insurance Commissioners.)

- S0632 by DiMario, Valverde ENTITLED, AN ACT RELATING TO STATE AFFAIRS AND GOVERNMENT – QUONSET DEVELOPMENT CORPORATION (Authorizes the Quonset development corporation to borrow up to $1m for operational purposes, the debt would not be a debt of the state and would be secured only by the Quonset development corporation’s assets.)

- S0787 by Ruggerio, McCaffrey, Goodwin ENTITLED, AN ACT RELATING TO STATE AFFAIRS AND GOVERNMENT – EXECUTIVE OFFICE OF COMMERCE (Creates a deputy secretary of commerce and housing within the executive office of commerce to oversee housing initiatives and develop a housing plan.)

- S0789 (Secretary of State) by Archambault, Pearson ENTITLED, AN ACT RELATING TO CORPORATIONS, ASSOCIATIONS AND PARTNERSHIPS – RHODE ISLAND BUSINESS CORPORATION ACT (Requires that annual reports of domestic and foreign business corporations, nonprofit corporations, and limited liability companies be filed with the secretary of state between February 1 and May 1 of each year.)

5pm Senate Committee on Judiciary

SCHEDULED FOR CONSIDERATION

- S0015 by McCaffrey, Raptakis, Gallo, Goodwin ENTITLED, RESOLUTION TO APPROVE AND PUBLISH AND SUBMIT TO THE ELECTORS A PROPOSITION OF AMENDMENT TO THE CONSTITUTION OF THE STATE – PROCEDURE TO FILL VACANCY IN OFFICE OF THE SECRETARY OF STATE, ATTORNEY GENERAL OR GENERAL TREASURER (This joint resolution would present to the electors a Rhode Island constitutional amendment which would create a procedure to fill vacancies in the offices of secretary of state, attorney general or general treasurer.)

- S0057 by McCaffrey, Raptakis, DiPalma, Gallo, Goodwin ENTITLED, AN ACT RELATING TO ELECTIONS – GENERAL STATE OFFICES (Requires a special election to fill a vacancy in the office of secretary of state, attorney general or general treasurer if more than one year is left in the term of office.)

- S0059 by Ruggerio, Coyne, Seveney, DiPalma, Burke ENTITLED, AN ACT RELATING TO STATE AFFAIRS AND GOVERNMENT – STATEWIDE PUBLIC SAFETY COMPUTER AIDED DISPATCH RECORDS MANAGEMENT SYSTEM (Establishes a statewide public safety computer aided dispatch records management system.)

- S0060 by Goldin, Valverde, DiMario, Cano, Murray ENTITLED, AN ACT RELATING TO ELECTIONS – RHODE ISLAND CAMPAIGN CONTRIBUTIONS AND EXPENDITURES REPORTING (Permits campaign funds to be used to pay all childcare expenses that are incurred as a direct result of campaign activity.)

- S0264 by Coyne, Sosnowski, Valverde, Burke, Seveney, Euer ENTITLED, AN ACT RELATING TO FINANCIAL INSTITUTIONS – THE ELDER ADULT FINANCIAL EXPLOITATION PREVENTION ACT (Requires employees of regulated financial institutions to report suspected financial exploitation of elder adults to the office of healthy aging and provide authority to the regulated financial institution to place a temporary hold on transactions.)

- S0392 by F Lombardi, McCaffrey, Archambault, Euer, Ciccone, Lombardo ENTITLED, AN ACT RELATING TO PROPERTY – CONDOMINIUM LAW – RESALE OF UNITS (Allows a condominium association to impose a fee of up to $125 for preparation of a resale certificate.)

- S0398 by Burke, Archambault, DiPalma, Lombardo, F Lombardi, Gallo, DiMario ENTITLED, AN ACT RELATING TO DOMESTIC RELATIONS – MARRIAGE LICENSES (Repeals the provision of law granting minors the ability to obtain a marriage license, and would require a person to be of full legal age, at least 18 years of age to obtain a marriage license.)

- S0412 by DiMario, Coyne, Valverde, DiPalma, Sosnowski, Goodwin, Goldin, Cano, Mack, Bell ENTITLED, AN ACT RELATING TO HUMAN SERVICES – ABUSED AND NEGLECTED CHILDREN (Requires the department of children, youth and families to report all suspected cases of child sexual abuse to the children’s advocacy center.)

- S0600 by Paolino, de la Cruz, Quezada, Rogers, Pearson ENTITLED, AN ACT RELATING TO COURTS AND CIVIL PROCEDURE-PROCEDURE GENERALLY – FEES (Raises the juror’s fees for each day’s attendance on the superior court from $15 per day to $25 per day commencing July 1, 2022, and increases to $35.00 per day commencing July 1, 2023, and thereafter.)

- S0607 by McCaffrey, Anderson ENTITLED, AN ACT RELATING TO AERONAUTICS – THE PERMANENT AIR QUALITY MONITORING ACT (Extends the long-term air-quality monitoring program at TF Green Airport to July 31, 2024.)

- S0679 (Judiciary) by Archambault, Burke ENTITLED, AN ACT RELATING TO DOMESTIC RELATIONS – SOLEMNIZATION OF MARRIAGES (Adds the administrator of the supreme court as an individual authorized to perform marriages and would clarify that the current administrators of the superior court, family court, district court, or traffic tribunal are empowered to perform marriages.)

- H5394 by Cortvriend, Ruggiero, Shekarchi, Bennett, Handy, Cassar, McGaw, Henries, Kislak ENTITLED, AN ACT RELATING TO STATE AFFAIRS AND GOVERNMENT – PRESERVATION OF FAMILIES WITH DISABLED PARENT ACT (Precludes a parent’s disability from serving as the sole basis for the state to institute an investigation of the disabled parent’s family.)

SCHEDULED FOR HEARING AND/OR CONSIDERATION

- S0506 (by request) by Picard ENTITLED, AN ACT RELATING TO GENERAL ASSEMBLY – REDISTRICTING (Requires for adoption of redistricting legislation an affirmative vote of a majority of representatives and senators voting by each of the two chambers and by a majority of representatives and senators in the largest two member-represented political parties.)

- S0537 by Calkin, Acosta, Anderson, DiMario, Bell, Ciccone, Quezada, Mack, Kallman, Valverde ENTITLED, AN ACT RELATING TO THE GENERAL ASSEMBLY – SPECIAL COMMISSION ON REAPPORTIONMENT (Creates an 18 member special commission on reapportionment to redistrict the districts of the general assembly and the state’s congressional districts based on the data collected by the federal Census conducted in 2020 by January 15, 2022.)

- S0852 by Ruggerio, McCaffrey, Gallo, Coyne, Goodwin, Picard ENTITLED, AN ACT ESTABLISHING A REAPPORTIONMENT COMMISSION (Creates an 18 member special commission on reapportionment whose purpose is to draft and to report to the general assembly an act to reapportion the districts of the general assembly and the state’s United States Congressional districts.)

- S0864 by Euer, Valverde, DiMario, Algiere, Murray ENTITLED, RESOLUTION TO APPROVE AND PUBLISH AND SUBMIT TO THE ELECTORS A PROPOSITION OF AMENDMENT TO THE CONSTITUTION – REDISTRICTING (This proposed constitution amendment, if adopted, would adopt a specific constitutional procedure, including an independent redistricting commission, for redistricting.)

- S0194 by de la Cruz, Euer, Miller, Felag, DiPalma ENTITLED, AN ACT RELATING TO STATE AFFAIRS AND GOVERNMENT – ENERGY FACILITY SITING ACT (Increases membership from three to five members/revises siting process to mandate public/municipal participation.)

- S0254 by Lombardo, F Lombardi, Morgan, Rogers, Paolino, de la Cruz ENTITLED, AN ACT RELATING TO HEALTH AND SAFETY – REFUSE DISPOSAL-ELIMINATION OF POST-USE POLYMERS AND RECOVERED FEEDSTOCKS USED IN ADVANCED RECYCLING PROCESSES FROM SOLID WASTE (Exempts post-use polymers and recovered feedstocks used in advanced recycling processes from the definition of solid waste.)

- S0527 by Valverde, Euer, DiMario, Miller, Anderson, Raptakis ENTITLED, AN ACT RELATING TO HEALTH AND SAFETY- HIGH-HEAT WASTE FACILITY ACT OF 2021 (Prohibits new high-heat waste processing facilities.)

- S0521 by DiMario, Euer, Valverde, DiPalma, Seveney, Bell, Kallman, Anderson, Coyne ENTITLED, AN ACT RELATING TO CRIMINAL OFFENSES – TRESPASS AND VANDALISM (Prevents a person from being prosecuted for fishing, gathering seaweed, swimming or passage along the sandy or rocky shoreline within ten feet of the most recent high tide line.)

- S0308 by Archambault, McCaffrey, Coyne, DiMario, Burke ENTITLED, AN ACT RELATING TO ANIMALS AND ANIMAL HUSBANDRY – CRUELTY TO ANIMALS (Increases penalties for animal cruelty.)

- S0309 by Archambault, Euer, Coyne, Kallman, DiMario, McCaffrey, Burke ENTITLED, AN ACT RELATING TO ANIMALS AND ANIMAL HUSBANDRY – CRUELTY TO ANIMALS (Prohibits a person convicted of unnecessary cruelty to animals from owning or exercising control of an animal for life and be subject to fine of $1k for each violation of this act.)

- S0319 by Archambault, Lombardo, Kallman, Burke ENTITLED, AN ACT RELATING TO ANIMALS AND ANIMAL HUSBANDRY – CRUELTY TO ANIMALS (Authorizes a law enforcement or animal control officer to hold an animal confined in a motor vehicle up to 72 hours pending a district court hearing.)

- S0531 by Ciccone, Calkin, Ruggerio, Acosta ENTITLED, AN ACT RELATING TO ANIMALS AND ANIMAL HUSBANDRY – CRUELTY TO ANIMALS (Prohibits sale/offer for sale of cosmetic product by cosmetic manufacturer/supplier of cosmetic ingredients using animal testing, subject to penalty up to $1k.)

- S0534 by Ruggerio, McCaffrey, F Lombardi ENTITLED, AN ACT RELATING TO ANIMALS AND ANIMAL HUSBANDRY (Authorizes the potential appointment of pro bono attorneys, supervised law students and from a list maintained by the DEM to act as animal advocates in animal cruelty and abuse cases, at the court’s discretion, to serve the interests of justice.)

- S0601 (by request) by Algiere ENTITLED, AN ACT RELATING TO ANIMALS AND ANIMAL HUSBANDRY (Authorizes the potential appointment of pro bono attorneys, supervised law students and from a list maintained by the DEM to act as animal advocates in animal cruelty and abuse cases, at the court’s discretion, to serve the interests of justice.)

- S0806 by Archambault ENTITLED, AN ACT RELATING TO CRIMINAL OFFENSES – TRADE IN ANIMAL FUR ACT (Prohibits the sale, offer of sale, trade or distribution of fur products as defined and makes any violation punishable by a fine of $500 up to $5k and up to one year in jail.)