Understanding the proposed ‘Ballpark at Slater Mill’ for the Pawtucket Red Sox

The City of Pawtucket, the Pawtucket Red Sox (‘PawSox’), and the State of Rhode Island have partnered to propose the construction of a ‘Ballpark at Slater Mill’ (‘Ballpark’). The estimated cost of building the Ballpark is $96 million, which includes site preparation costs ($10 million), the actual construction of the Ballpark ($73 million), and $13 million in additional financing costs.

November 3, 2017, 3:56 pm

By Economic Progress Institute

The City of Pawtucket, the Pawtucket Red Sox (‘PawSox’), and the State of Rhode Island have partnered to propose the construction of a ‘Ballpark at Slater Mill’ (‘Ballpark’). The estimated cost of building the Ballpark is $96 million, which includes site preparation costs ($10 million), the actual construction of the Ballpark ($73 million), and $13 million in additional financing costs. The vast majority of this cost (all but $12 million in equity that the PawSox will be contributing up front) will be covered by selling bonds, which is how public infrastructure projects are typically financed. As a result of financing through bonds, the state will need to allocate $1.5 million every year for the duration of the 30-year bond, while the expectation is that the state will recover more than enough through additional tax revenues to cover this obligation.

The City of Pawtucket, the Pawtucket Red Sox (‘PawSox’), and the State of Rhode Island have partnered to propose the construction of a ‘Ballpark at Slater Mill’ (‘Ballpark’). The estimated cost of building the Ballpark is $96 million, which includes site preparation costs ($10 million), the actual construction of the Ballpark ($73 million), and $13 million in additional financing costs. The vast majority of this cost (all but $12 million in equity that the PawSox will be contributing up front) will be covered by selling bonds, which is how public infrastructure projects are typically financed. As a result of financing through bonds, the state will need to allocate $1.5 million every year for the duration of the 30-year bond, while the expectation is that the state will recover more than enough through additional tax revenues to cover this obligation.

The state would only be directly responsible for the bond payments of its partners if it chooses to ‘backstop’ their bond issues (meaning they would enter a legally binding agreement to honor their bond financing payments in the event the other parties weren’t able to). Even without a formal ‘backstop’ on Pawtucket’s bond issue, the state could find itself responsible for the city’s payments in extreme circumstances.[note] Under the provisions of the 2010 Fiscal Stability Act, the state has the authority to intervene to assist municipalities experiencing financial distress. The joint goals of the Act is to “provide a mechanism for the State to work with municipalities undergoing financial distress that threatens the fiscal well-being, public safety, and welfare of these communities, others, or the State…[and to] provide stability to the municipal credit markets for Rhode Island and its cities and towns through a predictable, stable mechanism for addressing cities and towns in financial distress.” Senator Daniel DaPonte, March 2017. Municipal Fiscal Distress: RI Fiscal Stability Act, National Conference of State Legislatures, http://www.ncsl.org/Portals/1/Documents/fiscal/Daniel_DaPonte.pdf. [/note]

Investing in public infrastructure is generally a positive thing for governments to do, supporting good jobs and contributing to economic recovery.[note]Elizabeth McNichol, 2017. It’s Time for States to Invest in Infrastructure, Center on Budget and Policy. https://www.cbpp.org/research/state-budget-and-tax/its-time-for-states-to-invest-in-infrastructure. [/note] This proposed public private partnership (PPP) investment in publicly owned infrastructure raises many important questions, which this policy brief addresses.

The following discussion outlines the range of issues that policy makers need to consider before proceeding with an investment of public money in a new stadium for the Pawtucket Red Sox:

A) Background

The Pawtucket Red Sox are the Triple A affiliate for the Boston Red Sox, the top level league for developing primarily young players, from which the Boston Red Sox can draw future players. The PawSox currently play out of McCoy Stadium (‘McCoy’) in Pawtucket. McCoy was completed in 1946, and has been home to the PawSox since 1969. While the stadium underwent significant renovations completed in 1999, the consensus is that the current stadium is no longer adequate for the needs of the team.

The PawSox want to build a new stadium.[note]A study of the current McCoy site estimates it would cost $78 million to tear down McCoy and build anew on the current site, $68 million to renovate McCoy and bring it up to Triple A standards, or $35.6 million to extend the life of the stadium another 20 years. City of Pawtucket, 2017. “The Ballpark at Slater Mill”, p. 8.[/note] Pawtucket wants the team to remain in Pawtucket. While the PawSox have been enthusiastic partners in the proposal to build a new stadium – the proposed “Ballpark at Slater Mill”, less than a mile from the current stadium – they have also been clear that they are willing to look elsewhere, including outside of Rhode Island, for a new stadium.

Currently the state generates an estimated $1.9 million a year in tax revenues from the team’s operations at McCoy[note]City of Pawtucket, Ibid, p. 17.[/note], from income taxes paid by the players and stadium workers, and sales tax on concession sales and ticket sales.

With current attendance levels, the PawSox’ financial situation is not strong. The team has indicated that it is a “small, stable, but declining business” entity.[note]Pawtucket Red Sox Baseball Club, Inc., letter to The Honorable William J. Conley, Jr., Chairman of the Senate Finance Committee, October 18, 2017.[/note] While its consolidated balance sheet reflects this, the team had not (as of October 27th) provided its annual profit and loss statement to either the Senate Finance Committee or the Commerce Corporation.[note]Kate Bramson and Katherine Gregg, October 26, 2017. “Senate Finance chairman: No vote on PawSox stadium without info on owners’ finances”, The Providence Journal. http://www.providencejournal.com/news/20171026/senate-finance-chairman-no-vote-on-pawsox-stadium-without-info-on-owners-finances [/note]

The City of Pawtucket faces many of the same challenges common to former New England mill towns. City officials see the Ballpark and planned ancillary development as part of a strategy to revitalize the City, particularly its downtown core. As Mary MacDonald writes for Providence Business News, “If the…Ballpark at Slater Mill comes to fruition, the [PawSox]…would provide an immediate anchor to an old city in desperate need of economic stabilization.” [note]Mary MacDonald, Providence Business News, October 27, 2017, https://pbn.com/pawtucket-leaders-think-finally-plan-jump-start-development-can-survive-loss-pawsox/. [/note] In a city with one in five[note]The US Census Bureau’s estimates for the 5-year poverty rate for the City of Pawtucket from the 2015, 2014, 2013, and 2012 American Community Surveys average to 20.0%. [/note] residents living under the federal poverty level in recent years, the promise of economic transformation has been well received.

The hope is that the Ballpark would complement the anticipated impact of the $40 million Pawtucket-Central Falls commuter rail station currently being built.

There is also, for some people, a significant but intangible consideration of the psychological/emotional value of having a Triple A baseball team in Rhode Island.[note]Currently, the Pawtucket Red Sox are the only professional sports team in the state other than the American Hockey League’s Providence Bruins.[/note]

The state’s share of the construction cost of the stadium is $23 million. The state is not required to pay that share in a single up-front installment, but rather, will finance through a 30-year bond issue. The annual cost of interest on the state’s bond issue is estimated to be about $1.5 million, and the total 30 year cost to the state (in nominal dollars, neither inflation-adjusted nor adjusted for net present value) is estimated to be $41.1 million by 2048.

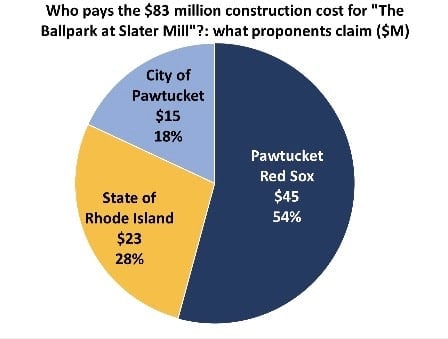

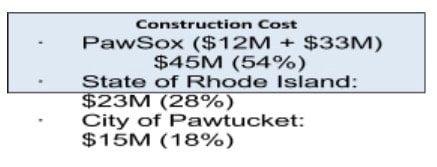

Construction cost

It is anticipated that construction of the Ballpark itself (including site preparation costs, but not including the cost of financing, discussed below) will cost $83 million, with the PawSox contributing $12 million up front and $45 million financed through a bond issue. The state of Rhode Island would contribute $23 million, and the City of Pawtucket would contribute $15 million, both also financed through separate bond issues. One source of risk in a construction project is the potential for cost overruns. The PawSox have agreed to cover any such cost overruns.

It is anticipated that construction of the Ballpark itself (including site preparation costs, but not including the cost of financing, discussed below) will cost $83 million, with the PawSox contributing $12 million up front and $45 million financed through a bond issue. The state of Rhode Island would contribute $23 million, and the City of Pawtucket would contribute $15 million, both also financed through separate bond issues. One source of risk in a construction project is the potential for cost overruns. The PawSox have agreed to cover any such cost overruns.

Financing the construction costs through bond issues

The bulk of the expense of constructing the ballpark will be covered through bonding, which is how governments (federal, state, and local) often pay for construction of public infrastructure, such as highways, bridges, government buildings, or public schools. Even governments facing significant fiscal challenges tend to be considered very safe bets for lenders in the bond market, which means governments can borrow money at rates lower than most other borrowers are able to. Interest rates for government borrowing have been at or near historically low levels in recent years.[note]For example, the annual 10-year long-term government bond yield (ie, interest rate) in 2016 was the second lowest it has been since 1960, at 1.84%. Federal Reserve Bank of St. Louis, FRED, “Long-Term Government Bond Yields: 10-year: Main (Including Benchmark) for the United States. https://fred.stlouisfed.org/series/IRLTLT01USA156N. [/note]

The bulk of the expense of constructing the ballpark will be covered through bonding, which is how governments (federal, state, and local) often pay for construction of public infrastructure, such as highways, bridges, government buildings, or public schools. Even governments facing significant fiscal challenges tend to be considered very safe bets for lenders in the bond market, which means governments can borrow money at rates lower than most other borrowers are able to. Interest rates for government borrowing have been at or near historically low levels in recent years.[note]For example, the annual 10-year long-term government bond yield (ie, interest rate) in 2016 was the second lowest it has been since 1960, at 1.84%. Federal Reserve Bank of St. Louis, FRED, “Long-Term Government Bond Yields: 10-year: Main (Including Benchmark) for the United States. https://fred.stlouisfed.org/series/IRLTLT01USA156N. [/note]

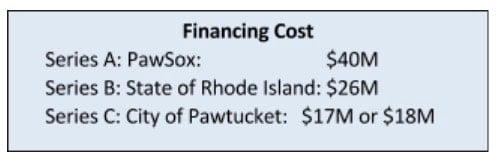

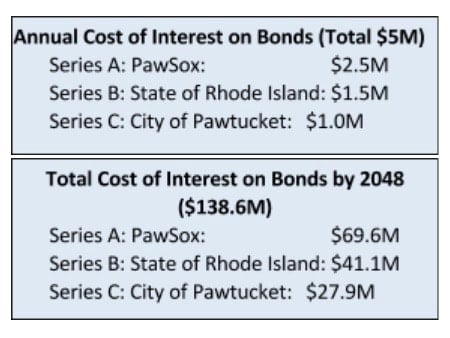

Borrowing money entails additional financing costs. The State Treasurer testified before the Senate Finance Committee that in order to net $71 million, the three Ballpark partners would need to raise $84 million through bond sales. When bonds are used to pay for a construction project, each ‘series’ of bonds is named successively (Series A, Series B, Series C, etc.). In the case of the Ballpark, the largest borrower, the Pawsox, would finance its contribution by Series A bonds, the State of Rhode Island by Series B, and Annual Cost of Interest on Bonds the City of Pawtucket by Series C, ranked corresponding to the size of the (Total $5M) respective bond issues.[note]Implicit in the ordering of bond series such as these is that each successive bond series is contingent on the successful financing of the previous bond series. [/note] The Treasurer’s estimate (aided by the State’s Fiscal Advisor, through the firm PRAG) is that Series A would need to be $40 million to accommodate the various costs of financing[note]These costs include “capitalized interest, debt service reserve fund, and costs of issuance.” PRAG, October 11, 2017, “Proposed Financing of New Downtown Pawtucket Ballpark”, p. 8.[/note], Series B would need to be $26 million, and series Series C would need to be either $17 million or $18 million, depending on whether the state ‘backstops’ the city’s debt.

Annual and total cost of servicing the bonds

Based on estimates from the state’s fiscal advisor, the annual cost of servicing the bonded debt would be $5 million, with the PawSox paying $2.5 million, the state paying $1.5 million, and the City paying $1.0 million.[note]Pawtucket Red Sox Baseball Club, October 18, 2017, Ibid.[/note]

Based on estimates from the state’s fiscal advisor, the annual cost of servicing the bonded debt would be $5 million, with the PawSox paying $2.5 million, the state paying $1.5 million, and the City paying $1.0 million.[note]Pawtucket Red Sox Baseball Club, October 18, 2017, Ibid.[/note]

The total cost assuming a 30-year bond period, and no state backstop, would be $138.6 million, with the PawSox paying $69.6 million, the state paying $41.1 million, and the City paying $27.9 million.[note]PRAG, 2017, Ibid. These estimates reflect actual nominal amount paid each year.[/note]

C) Ability of each partner to meet their financing obligations

Each of the Ballpark partners face two related issues in assessing their ability Series C: City of Pawtucket: $27.9Mto proceed with this project. The first is whether they have the capacity to take on additional bond debt, the second is whether they will be able to meet annual financing demands. For the public entities – the State of Rhode Island and the City of Pawtucket—a third question is whether this infrastructure project represents the most pressing need and most appropriate allocation of public dollars.[note] The Rhode Island School Building Task Force reported in September that Rhode Island’s 306 public schools need between $600 million and $2.2 billion in repairs in the coming years. School Building Authority at the Rhode Island Department of Education, State of Rhode Island Schoolhouses. http://www.ride.ri.gov/Portals/0/Uploads/Documents/Funding-and-Finance-Wise-Investments/SchoolBuildingAuthority/RIDE-Facility-Condition-Report2017_FINAL.PDF. According to this report, the City of Pawtucket faces the greatest “facility deficiency cost” per square foot of all Rhode Island municipalities. [/note]

The State

The state is currently well within the guidelines established by the Public Finance Management Board (PFMB) for its tax-supported debt.[note]ne tool for assessing the ability of the state to meet its bond financing obligations is an April 2017 report by the Office of the General Treasurer and the PFMB. The PFMB report outlines debt affordability targets for the state, its quasi-public agencies, and Rhode Island’s 39 municipalities.[/note] According to their guidelines, the state could take on an additional $1.15 billion in new bonds over the next ten years. As noted in the PRAG report, “The $24 million Series B bonds proposed to be financed by the State represents 2% of the State’s capacity in this 10 year period.”[note] Ibid, p. 4.[/note] While the state has debt room to take on debt to finance the Ballpark, the state’s looming budget crisis will cause the $1.5 million cost to service the debt to displace other spending priorities.

The City

The City of Pawtucket’s fiscal situation is less clearly solid, but still falls within a range that the PRAG analysis deems satisfactory. Of the four indicators the debt affordability study identifies for municipal debt targets, Pawtucket falls within the recommended range in three categories, falling short only in the category that combines both traditional debt and net pension liability. (Importantly, this category varies very little when comparing the outlook with and without debt servicing for the Ballpark).

What is clear (and remains largely unstated) is that the $15-$18 million in debt undertaken to support the Ballpark takes up debt-servicing room that might otherwise be used to support more urgent or more productive infrastructure investments for the City.

The PawSox

The PawSox have identified themselves as “a small, stable, but declining business”, with current liabilities of $7 million, net equity value of $11.2 million, and assets of $18.2 million.[note]Pawtucket Red Sox Baseball Club, Inc., letter to The Honorable William J. Conley, Jr., Chairman of the Senate Finance Committee, October 18, 2017. [/note] Importantly, 80 percent of that $18.2 million, is in the form of “Goodwill”, which is an accounting term that refers to the portion of a firm’s purchase price in excess of identifiable income producing assets.

In proceeding with the Ballpark, the PawSox are committing to take on a debt burden that is nearly four times its net equity value of $11.2 million.

D) What risk would the state be assuming in partnering with the Pawsox and the City of Pawtucket to build the Ballpark?

Assuming the State decides not to backstop the PawSox’s share of bonded debt, the primary risk is that the anticipated revenue stream (through various taxes) falls short of expectations. Annual state revenues (estimated to average $3.3 million over the first 6 years by B&D) would, however, have to fall far short of expectations to generate less revenue than required to cover the state’s average annual debt payment of $1.5 million.

E) Who benefits if stadium meets expectations? (ie, what are the potential upsides for each financing partner?)

If the Ballpark meets or exceeds estimates, the state should reap substantial revenues, particularly through sales tax generated in the Ballpark itself, and via sales tax revenues generated by visitors to Rhode Island attending PawSox games. The City would also benefit from additional revenues if attendance exceeds estimates, through the local meal and beverage tax, and the local hotel tax.[note]The Chief of Revenue Analysis, Paul Dion, testified that the income tax figures included in the B&D study “seemed rather rich”. Kate Bramson, Providence Journal, “Plenty of support, but also calls for voters to decide on PawSox stadium support”, http://www.providencejournal.com/news/20171019/plenty-of-support-but-also-calls-for-voters-to-decide-on-pawsox-stadium-support [/note]

The PawSox have committed (via a “Reinvest in Rhode Island pledge”) that owners living or operating businesses in Rhode Island will donate their share of profits in the first five years to three state based philanthropic foundations: the Rhode Island Foundation, the Pawtucket Foundation, or the Pawtucket Red Sox Foundation. After the initial 5-year period of operation, all profits generated by the Pawtucket Red Sox baseball operations would accrue only to the PawSox.

F) Good Jobs: What protections are there that jobs created both during the construction and operation of the Ballpark are “Good Jobs”?

While the Ballpark partners have agreed that the Ballpark will be constructed using Union Labor, additional protections should be pursued to ensure that the jobs created for the operation of the Ballpark, including concessions, the box office, or custodial services, be paid wages that allow them to meet their basic needs[note]The 2016 Rhode Island Standard of Need showed that an individual would need to earn at least $12.38/hour to meet their basic needs. [/note], and to require that all such personnel either be employed directly (by either Ballpark or the PawSox), or jointly employed as provided by the Fair Labor Standards Act, such that either the stadium or the team would be either solely or jointly responsible for compliance with both federal and state labor standards, including provisions that prevent labor misclassification by incorrectly designating workers as “independent contractors”.

Given that Pawtucket’s overall poverty rate in 2016 was 15.6 percent (even higher for Black (15.9 percent) and Latino (18.4 percent) of Pawtucket residents), such provisions could help Pawtucket families meet their basic needs, while also raising the floor for the local service sector labor market. The State of Rhode Island and City of Pawtucket should ensure not only that the Ballpark create jobs, but that those jobs end up being good jobs.

G) What ‘red flags’ should policy makers consider?

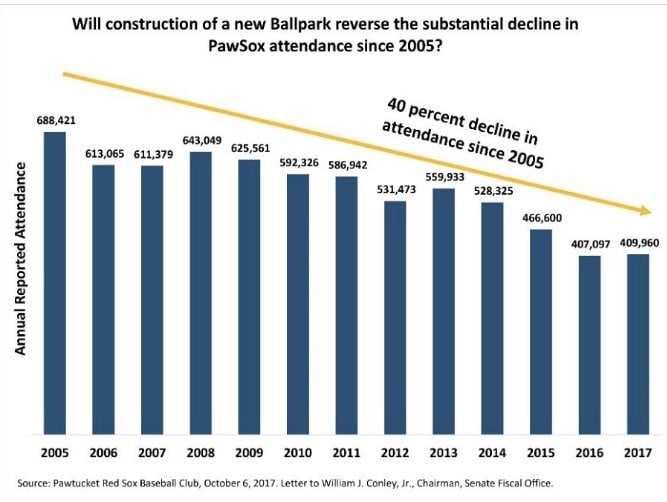

- Attendance: The financial success of the Ballpark is tied to the ability of the PawSox to reverse declines in attendance[note]In other materials, there has been a significant disparity between “paid attendance” and “gate attendance”. Given the importance of physical attendance at the game to drive concession sales, a major revenue stream for the team, growing the number of people actually attending games is critical.[/note] that have been ongoing since at least 2005, when attendance for the season totaled 688,421.

- Financial projections for the Ballpark assume that attendance at the Ballpark will increase to 550,000 annually (8,100 per game), an increase of 35 percent from current attendance levels.[note]The state’s fiscal advisor, Janet Lee, noted that “there’s a lot of uncertainty around the stream of revenues that would be used to pay the Series A debt.” Testimony before the Senate Finance Committee, Pawtucket Red Sox Hearings, October 11, 2017.[/note] The anticipated revenue streams intended to finance all three bond series are heavily dependent upon attendance projections meeting or exceeding expectations.

- PawSox Financial Situation: The continued reluctance of the PawSox to provide profit and loss statements to both the Senate Finance Committee and the Commerce Corporation is a cause of concern. The Chair of the Senate Finance Committee, Senator Conley, has indicated the bill authorizing the state to enter into a partnership to fund the Ballpark will not move forward until the PawSox satisfy their concerns.

- November 3, 2017 update: The PawSox have agreed to release their profit and loss statements, but only to Rhode Island’s Auditor General, and on condition that he not share the details.[note]Donita Naylor, Kate Bramson, November 2, 2017. “PawSox owners agree to share profit and loss statement with RI auditor general”, http://www.providencejournal.com/news/20171102/pawsox-owners-agree-to-share-profit-and-loss-statement-with-ri-auditor-general[/note]

Endnotes