Revenue for RI kicks off campaign to tax the one percent

“The gap between the rich and poor continues to widen due to decades of policies that have helped the rich get richer,” said Senator Murray. “We can’t keep balancing budgets by cutting vital social service programs that our most vulnerable citizens depend on, especially in the middle of a pandemic.”

February 23, 2021, 4:16 pm

By Steve Ahlquist

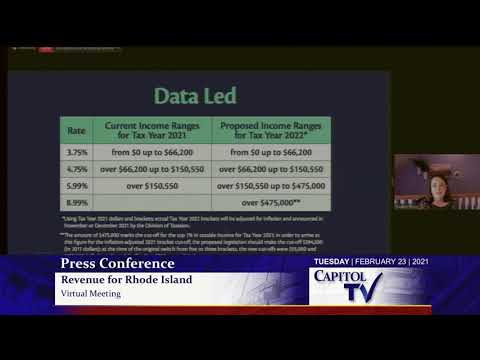

The Revenue for Rhode Island coalition kicked off their 2021 campaign today to raise revenue for the state by adding one new tax bracket – at a marginal rate of 8.99% (in place of the current top rate of 5.99%) on income above $475,000, ensuring the top 1% of earners are contributing their fair share. The legislation, S0326, sponsored by Senator Melissa Murray (Democrat, District 24, Woonsocket, North Smithfield), and H5227, sponsored by Representative Karen Alzate (Democrat, District 60, Pawtucket), is estimated to raise $128.2 million in new tax revenue, and would only impact the top 1% of tax filers.

“The top one percent of Rhode Islanders have benefitted the most from a number of federal and state income tax cuts over the past two decades,” said Rachel Flum, executive director of the Economic Progress Institute. “Starting with the Bush tax cuts of the early 2000s, the Carcieri state tax cuts in 2010, to the Trump tax cuts in 2017, which alone save the the average top one percent a whopping $35,000 per year.”

Carl Davis from the Institute on Taxation and Economic Policy (ITEP) refuted the idea that higher taxes on the top one percent will result in an exodus of top wage earners from the state. “You’re always going to hear anecdotes to support this story,” said Davis. “The examples are so exceedingly rare though that they don’t show up in the data.” In fact, millionaires have one of the lowest rates for moving between states and there’s no meaningful draw from the higher tax rate states and states with lower tax rates.

As for higher taxes resulting in an economic slowdown, “The academic literature does not show any kind of convincing link between the top tax rate and economic growth in the state,” says Davis.

“The gap between the rich and poor continues to widen due to decades of policies that have helped the rich get richer,” said Senator Murray. “We can’t keep balancing budgets by cutting vital social service programs that our most vulnerable citizens depend on, especially in the middle of a pandemic. This legislation will not only help us address our short-term budget deficits, but also allow us the flexibility to properly fund critical programs and services on an ongoing basis. This helps put our state on more solid financial footing going forward, and ensures a more equitable tax structure.”

“With Rhode Island once again facing a sizable budget deficit and still some level of uncertainty on a federal relief package, it is imperative that our state raise revenue so that crucial and often life-saving programs and services remain available to Rhode Islanders in need,” said Representative Alzate. “The pandemic has taken a massive toll on lower and middle class Rhode Islanders – we can’t keep asking them to absorb more and more cuts without asking the wealthiest Rhode Islanders to chip in. We’re simply asking the wealthiest 1% to pay a small percentage more on income above and beyond $475,000, while having no impact on those Rhode Islanders making less than that amount.”

“In Rhode Island, lower and middle class families have been paying a higher percentage of their income in overall taxes than the wealthiest Rhode Islanders,” said RI AFL-CIO President George Nee, who also emceed the event. “This proposal would put the top 1% more in line with the next 79% of taxpayers. It’s time, as a state, that we recalibrate our priorities, start ensuring those making more than $475,000 contribute their fair share, and make our budget work for all Rhode Islanders.”

“For too long we have given millionaires big tax breaks instead of investing in services and programs that help lower and middle class residents,” said Marlene Guay, a Woonsocket resident and employee of United Way Rhode Island. “This legislation provides a more equitable path forward, allowing us more money to invest in schools and education, infrastructure, programs for elderly residents and individuals living with developmental disabilities, and our veterans. We can also use these funds to increase state funding to cities and towns, which can help lower property taxes.”

“As a small business owner, I support this proposal because it’ll help stimulate the economy and promote job creation from the ground up, at a time when we need it most” stated Kara Larson, co-owner of Rhode Island Spirits in Pawtucket. “The median taxable income of self-employed Rhode Islanders is under $54,000 per year, and roughly 96% of small business owners in Rhode Island make less than $475,000 a year. This bill will help get money flowing amongst the other 99% of Rhode Islanders, which in turn will help almost all small businesses.”

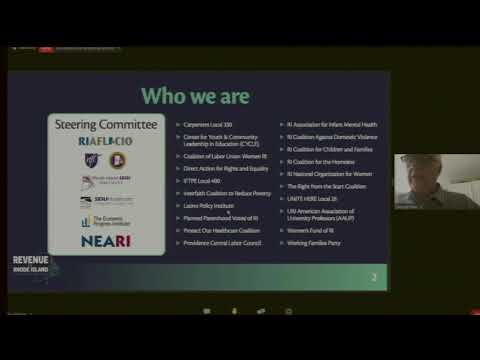

Revenue for Rhode Island coalition members include the RI AFL-CIO, NEARI, RIFTHP, SEIU State Council, SEIU District 1199, Economic Progress Institute, Carpenters Local 330, Center for Youth & Community Leadership in Education (CYCLE), Coalition of Labor Union Women RI, Direct Action for Rights and Equality, IFTPE Local 400, Interfaith Coalition to Reduce Poverty, Latino Policy Institute, Planned Parenthood Votes! of RI, Protect Our Healthcare Coalition, Providence Central Labor Council, RI Association for Infant Mental Health, RI Coalition Against Domestic Violence, RI Coalition for Children and Families, RI Coalition for the Homeless, RI National Organization for Women, The Right from the Start Coalition, UNITE HERE Local 26, URI American Association of University Professors (AAUP), Women’s Fund of RI, and the Working Families Party.