PVD’s Pension Working Group membership skews right-wing, anti-worker

I noticed that you have groups like RIPEC and the Providence Chamber that are notoriously anti-worker when they are at the State House advocating against things like minimum wage, advocating against worker policies. And I was wondering who on the Pension Working Group represents a less… neoliberal, right-wing point of view on that panel?

July 27, 2021, 1:42 pm

By Steve Ahlquist

On Monday Providence Mayor Jorge Elorza announced a Pension Working Group to consider and recommend a comprehensive proposal to address Providence’s structural financial challenges, including the risks and benefits of a Pension Obligation Bond and any additional avenues for structural reform.

Appointees to the Pension Working Group include:

- Providence Mayor Jorge Elorza

- Providence Foundation Executive Director Cliff Wood

- Greater Providence Chamber of Commerce President Laurie White

- Rhode Island Public Expenditure Council (RIPEC) President and CEO Michael DiBiase

- Rhode Island Governor Daniel McKee or his designee

- Speaker of the House Joseph Shekarchi or his designee

- President of the Senate Dominick Ruggerio or his designee

- Two members of the Providence City Council, selected by Council President John Igliozzi

- Mackey McCleary, financial advisor

- Kristin Fraser, financial advisor

- Financial advisor – to be announced

On Tuesday Uprise asked Mayor Elorza about the makeup of the group, which includes conservative pro-business, anti-worker organizations such as the RIPEC and the Greater providence Chamber of Commerce.

UpriseRI: I noticed that you have groups like RIPEC and the Providence Chamber that are notoriously anti-worker when they are at the State House advocating against things like minimum wage, advocating against worker policies. And I was wondering who on the Pension Working Group represents a less… neoliberal, right-wing point of view on that panel?

Elorza: I think that this is an area where this is a convergence of interests. All of the unions have come out in support of the proposal we put forward for a pension obligation bond. So I believe that this is something that we can all get behind. The perspectives that we wanted to have at the table were political leaders, stakeholders [such as RIPEC and the Greater Providence Chamber of Commerce] and financial professionals. This is really, really technical stuff and we want to get it right – but I do believe that this is an area where there’s a convergence of interests. If we do this right, not only will our workers be protected, but the city will be in much better financial shape.

Though Mayor Elorza seems focused on selling the idea of issuing pension obligation bonds, RIPEC’s Michael DiBiase is taking a broader, more comprehensive approach, telling The Public Radio‘s Ian Donnis that “I don’t want to front-run the working group. I think it’s important that that’s an open process. I would say that we need to think more broadly about the city’s finances in terms of state contributions, revenues, and we’re going to need to put more things in play to actually try to solve these issues.”

For a critique of Pension Obligation Bonds, see: Tom Sgouros: Jorge and John bet big

From the City:

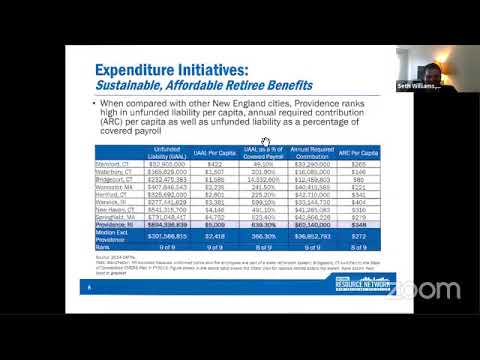

“Although the City has made 100% pension payments for the last 10 fiscal years, payments have steadily risen by an average of nearly 5% per year, outpacing the growth of the City’s tax base. The City’s recently adopted FY22 Budget allocated $93,585,060 to the pension fund. Despite these actions, the City’s current unfunded liability totaled $1.265 billion (22.17% funded) as of June 2020. According to the most recent actuarial report, the City’s current payment schedule is forecasted to surpass $200 million in less than 20 years and peak at $227 million in FY2040.

“Earlier this year, Senators Goodwin, Bell, Quezada and Mack introduced Senate Bill 0927 and Representatives Slater, Morales, Williams, Batista, Biah, Hull and Diaz introduced House Bill 6356 to the Rhode Island General Assembly authorizing the City of Providence to issue a 25-year, fixed-rate, Pension Obligation Bond (POB) for an amount not to exceed $850 million. Pension Obligation Bonds are bonds issued by a municipality from which the proceeds are used to reduce the accrued unfunded liabilities of its pension system.

State approval is necessary because “under the law the City may not acquire any debt, unless otherwise excepted by law, greater than 3% of the assessed value of taxable property without legislative approval. Authorizing legislation by the General Assembly regarding the Pension Obligation Bond would not be included in the City’s 3% debt limit.”

Working group announcement:

First Working Group meeting:

Attending the first meeting:

- Providence Mayor Jorge Elorza

- Greater Providence Chamber of Commerce President Laurie White

- Rhode Island Public Expenditure Council President (RIPEC) and CEO Michael DiBiase

- Governor Daniel McKee’s designee

- Rico Vota

- Speaker of the House K. Joseph Shekarchi’s designee

- Representative Camille Vella-Wilkinson

- Two members of the Providence City Council, selected by Council President Igliozzi

- Councilman Pedro Espinal

- Councilwoman Helen Anthony

- Mackey McCleary, financial advisor

- Kristin Fraser, financial advisor

July 27, 2021 Materials: