Reclaim RI responds to House budget that refuses to increase taxes on the one percent

“There is still time for the Assembly to do the right thing, and we hope that our state’s leaders will amend the budget to bring some fairness to our state taxes and invest in our communities for the long term,” said Reclaim Rhode Island in statement.

June 20, 2021, 10:46 am

By Steve Ahlquist

Rhode Island House Speaker Joseph Shekarchi (Democrat, District 23, Warwick) relied on disproven economic ideas and caved to threats from rich and connected business owners when he released the draft 2022 Rhode Island State Budget on Thursday.

Speaker Shekarchi said he is careful about the tax structure because “I don’t want to drive businesses out of Rhode Island,” an idea based on the disproven lie that the rich will flee the state to avoid a small increase in taxes.

The Speaker then told an anecdotal story, in which a business owner essentially threatened to leave the state if his taxes increased. “I talked to a business in northern Rhode Island, and they were very very concerned with the so-called Tax the Rich. It was a big, large insurance company and he’s like, two-three miles from the Massachusetts border. He made it very clear to me…” The Speaker did not complete the thought, but the indication is that the business owner threatened to leave the state if he is subjected to higher taxes on earnings over $475k.

Speaker Shekarchi also suggested that small family businesses would be subject to this tax. This is also not supported by evidence. Shekarchi also suggested that small family businesses would be subject to this tax. This is also not supported by evidence. Less than one percent of pass-through businesses in Rhode Island declare profits of over $475k, and those that do are mostly elite law firms. Less than one percent of pass-through businesses in Rhode Island declare profits of over $475k, and those that do are mostly elite law firms.

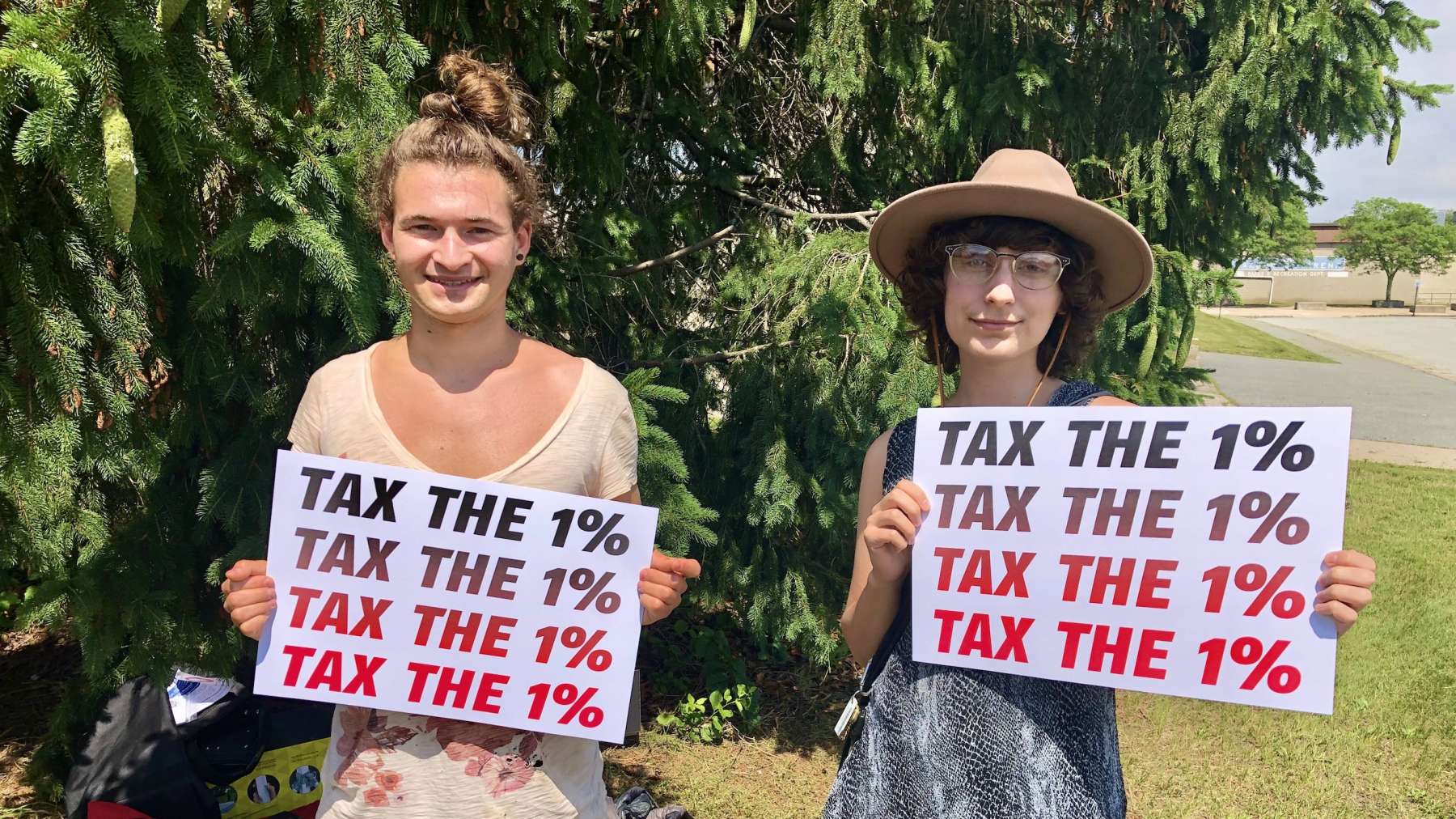

Organizers from Reclaim Rhode Island responded on Friday to the amended budget passed by the House Finance Committee, which fails to include any proposal to tax the state’s top 1% of income earners. Reclaim RI has been leading the advocacy fight for an increase in taxes on the richest Rhode Islanders.

See:

- Advocates press Speaker Shekarchi to increase taxes on the one percent

- Activists call on RI House to raise taxes on the one percent

“We are deeply disappointed by our representatives’ decision not to generate hundreds of millions of dollars in annual revenue that could be used for crucial services like education, housing, and healthcare. Taxing the 1% – people who earn over $475,000 per year – would ensure the long-term financial stability of our state,” said Cassie Tharinger, Co-Chair of Reclaim Rhode Island’s campaign to Tax the Rich.

Reclaim Rhode Island noted that it has the support of thousands of voters across the state who they contacted throughout the spring, including residents of Speaker Shekarchi’s Warwick district. The organization has also collected hundreds of handwritten postcards in support of the revenue proposal, which they sent on to legislators this week.

“The recovery from the pandemic will be expensive, and the federal dollars will dry up,” added Warwick City Councilmember Jeremy Rix. “When that happens, we will have to pay the bill. Either we tax those who can afford it, or those who can’t afford it will foot the bill through higher property and sales taxes. Ensuring that the wealthy pay their fair share is the right thing to do.”